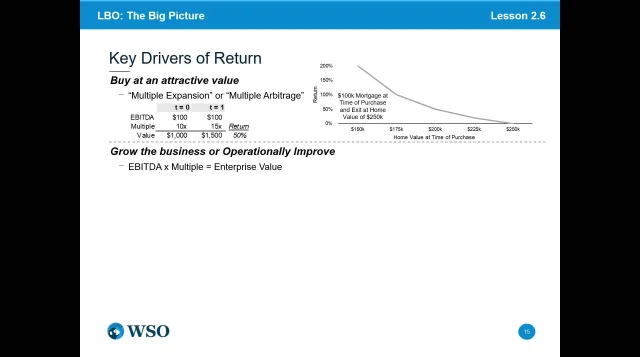

In this module, there are 14 video lessons provided to introduce LBO to you at a very high level. You will be learning the fundamental theories in LBO before we dive into practices including leverage, debt paydown & return, key drivers of return and internal rate of return. This module wraps up with a “Paper LBO” exercise and a leveraged buyout of Nike case.

In this module, we use 14 video lessons to provide you with an overview of sources and uses of cash in an acquisition, as well as help you build a robust understanding of fundamentals you need to know. You will be focusing on the theories, learning about key terms and definitions, but don’t worry, the applications are in the next module…

In this module, there are 3 video lessons to walk you through some of the key changes in P&L and adjustments made for LBO. You will be given the opportunity to practise your modeling and linking skills for the income statement and cash flow statement.

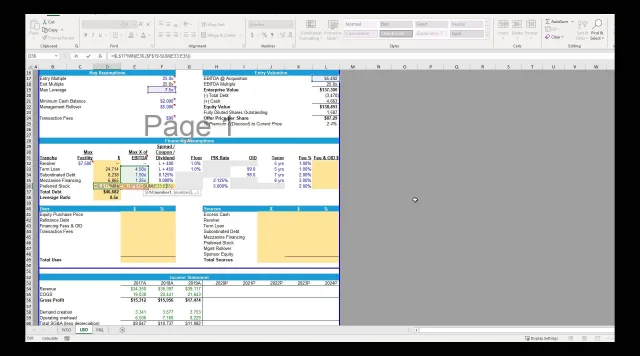

The 5 video lessons in module 2 provide you with a basic understanding of valuation and transaction assumptions we make when building LBOs. You will be learning adjusted EBITDA, acquisition multiple, building enterprise value to equity value, implied share price and other key assumptions.

In this module, we will apply the fundamentals to a real-life application. This is the fun part…you will work on financing assumptions, fill in the uses and sources for the Nike case.

In this module, there are 16 video lessons that teach arguably the most important part of an LBO. This module provides a walkthrough on how to build a debt schedule in excel and also includes a variety of topics such as calculation of cash flow available for debt service, revolver schedule, subordinated debt schedule, credit metrics and so on.

In module 9, there are 7 video lessons cover taxes and their impact on LBO. You will be learning about 2017 Tax Reform, discussing limitations around interest deductibility, calculating disallowed interest carryforward & accelerated Capex expensing, building Net Operating Losses, and completing the tax schedule.

Three bonus modules, 24 video lessons, 3 additional topics related to an LBO…They cover purchase price accounting, dividend recap and add-on acquisition build. Each bonus module will dive into its topic and discuss how each topic applies to an LBO specifically with excel model exercises.

WSO LBO Modeling Course – Video Preview

Below you will find a list of the modules and lessons included in this course.

Purchase this course you will earn

Purchase this course you will earn