In this module, we use 15 video lessons to explain the theory and logic behind valuation before we put this knowledge into practice with a Nike case. Learn the difference between intrinsic and relative valuation, enterprise vs equity value, and more.

In this module, we use 10 video lessons to explore enterprise value and equity value, a bit more in-depth by applying the knowledge we gained so far across a number of practice exercises.

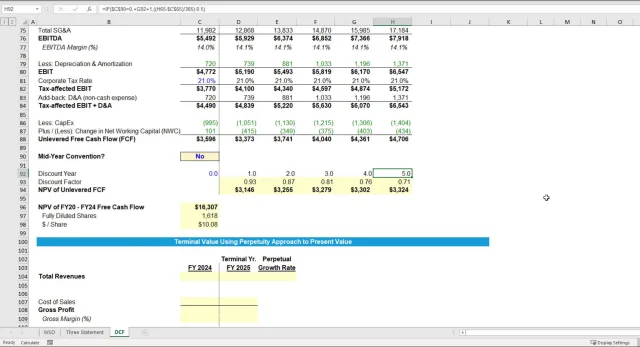

In this module, we use 9 video lessons to fully break down a DCF analysis. This module will also go into key terminology, how to locate information and drivers of Free Cash Flow Projections.

In this module, we use 8 video lessons to explain Unlevered vs. Levered Free Cash Flow and how to calculate and project Net Working Capital. We also learn sample ratios used by professionals to project UFCF.

This module uses 8 video lessons to cover how to calculate the Weighted Average Cost of Capital and its implications on valuations.

In this module, we use 13 video lessons to go over how to derive a company’s share price from the Net Present Value of Future Cash Flows. Here is where you get the final output of a DCF.

During the course, we will be using Nike, Inc. as our primary case to construct a DCF and demonstrating the calculations used throughout the model to make sure the examples and illustrations are realistic.

WSO DCF Modeling Course – Video Preview

Below you will find a list of the modules and lessons included in this course.

Purchase this course you will earn

Purchase this course you will earn