$397.00 Original price was: $397.00.$55.00Current price is: $55.00.

How to Learn Oil & Gas Valuation and Financial Modeling and Dominate Your Investment Banking Interviews – and Race to the Top of the Bonus Ladder After You Land Your Offer and Start Working

The Breaking Into Wall Street Oil & Gas Modeling Course is

hands-down the fastest way to master real-world Oil & Gas Financial Modeling and Valuation, with Step-by-Step Video Tutorials, a Case Study Based on a $41 Billion M&A Deal, Unlimited Lifetime Support, and an Unconditional

Money-Back Guarantee.

Purchase this course you will earn 55 Points worth of $5.50

Purchase this course you will earn 55 Points worth of $5.50How to Learn Oil & Gas Valuation and Financial Modeling and Dominate Your Investment Banking Interviews – and Race to the Top of the Bonus Ladder After You Land Your Offer and Start Working

The Breaking Into Wall Street Oil & Gas Modeling Course is

hands-down the fastest way to master real-world Oil & Gas Financial Modeling and Valuation, with Step-by-Step Video Tutorials, a Case Study Based on a $41 Billion M&A Deal, Unlimited Lifetime Support, and an Unconditional

Money-Back Guarantee.

What You Get… And What The BIWS Oil & Gas Modeling Course Will Do For You…

This is advanced training for both new and experienced professionals. The Oil & Gas Modeling course is perfect for you if:

- You already know the fundamentals of accounting, valuation, and financial modeling, and now you want to learn how the energy industry works in-depth.

- You’re interviewing with oil & gas groups – at banks, PE firms, hedge funds, or any other finance firm.

- You’re about to start working in an oil & gas group, or you’ve just transferred into one and need to get up to speed quickly.

- You’re an experienced professional and you’ve worked in the energy industry before – and now you’re transitioning into investment banking, private equity, or related roles.Whenever you’re interviewing for these roles at investment banks, you’ll always get a few questions over and over…

- How much do you know about accounting? Do you know how it’s different for oil & gas companies?

- Can you walk me through how you would value an oil & gas company?

- What are the key factors that impact an oil & gas company’s valuation and financial performance?

- How would you describe your financial modeling skills?Confidently answering all these questions and showing evidence of the case study you completed will set you apart from everyone else in the interview room and put you in prime position to land lucrative internships and jobs at investment banks, private equity firms, and hedge funds.

We’ve designed the course from the ground up to help you gain functional mastery of this highly-specialized material in the shortest possible time.

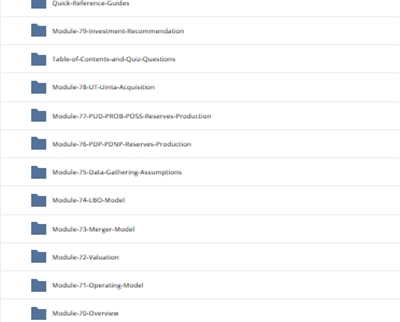

Here’s what you’ll get, and everything you’ll learn with hands-on practice via the case study of Exxon Mobil’s $41 billion acquisition of XTO Energy:

- Overview and Operating Model lessons teach you how to project and work with production and reserves… successful efforts vs. full cost accounting… and how to link revenue and expenses to hedging, price realization, and unit of productionassumptions; a complex debt schedule and alternative operating model for Exxon Mobil are also covered.

- Valuation module covers public comps and precedent transactions for energy companies…the key metrics and multiples to use… how a DCF is different… and how to create a full Net Asset Value (NAV) model based on data in SEC filings and equity research.

- Merger Model lessons teach you how to use the actual Exxon Mobil – XTO Merger Agreement to make assumptions… how to combine the 3 statements for oil & gas companies… and how acquisition effects, synergies, contribution analyses, and accretion / dilution differ for energy companies.

- LBO Modeling module covers the key differences when modeling oil & gas companies… how to modify XTO’s debt schedules to support refinancing and 7 new debt tranches… and how to analyze returns based on commodity prices.

The entire course is integrated with real SEC filings and equity research from banks like JP Morgan, Credit Suisse, and Deutsche Bank – so you’ll learn how to use all of those as you would in real life at a bank.

Tag: Oil and Gas Modeling – Breaking Into Wall Street Review. Oil and Gas Modeling – Breaking Into Wall Street download. Oil and Gas Modeling – Breaking Into Wall Street discount.

Only logged in customers who have purchased this product may leave a review.

Related products

Uncategorized

= 35 Points

Uncategorized

Managing Patient Emergencies: Critical Care Skills Every Nurse Must Know – Dr. Paul Langlois

= 85 Points

= 85 Points

Uncategorized

= 85 Points

Uncategorized

= 35 Points

= 84 Points

Uncategorized

Optimizing Compliance and Maximizing Revenue for Ophthalmology and Optometry – Jeffrey P. Restuccio

= 85 Points

Uncategorized

= 85 Points

Reviews

There are no reviews yet.