$2,074.00 Original price was: $2,074.00.$394.00Current price is: $394.00.

Purchase this course you will earn 394 Points worth of $39.40

Purchase this course you will earn 394 Points worth of $39.40Elevate your skills with the Mark Rose – Bread and Butter Trader course, available for just $2,074.00 Original price was: $2,074.00.$394.00Current price is: $394.00. on Utralist.com! Browse our curated selection of over 60,000 downloadable digital courses across diverse Forex and Trading. Benefit from expert-led, self-paced instruction and save over 80%. Start learning smarter today!

Purchase Mark Rose – Bread and Butter Trader courses at here with PRICE $2074 $394

Bread and Butter Trader

Bread and Butter Trader Final Review

I am wrapping up this trial a couple of weeks early as I do not trade the run in to Christmas.

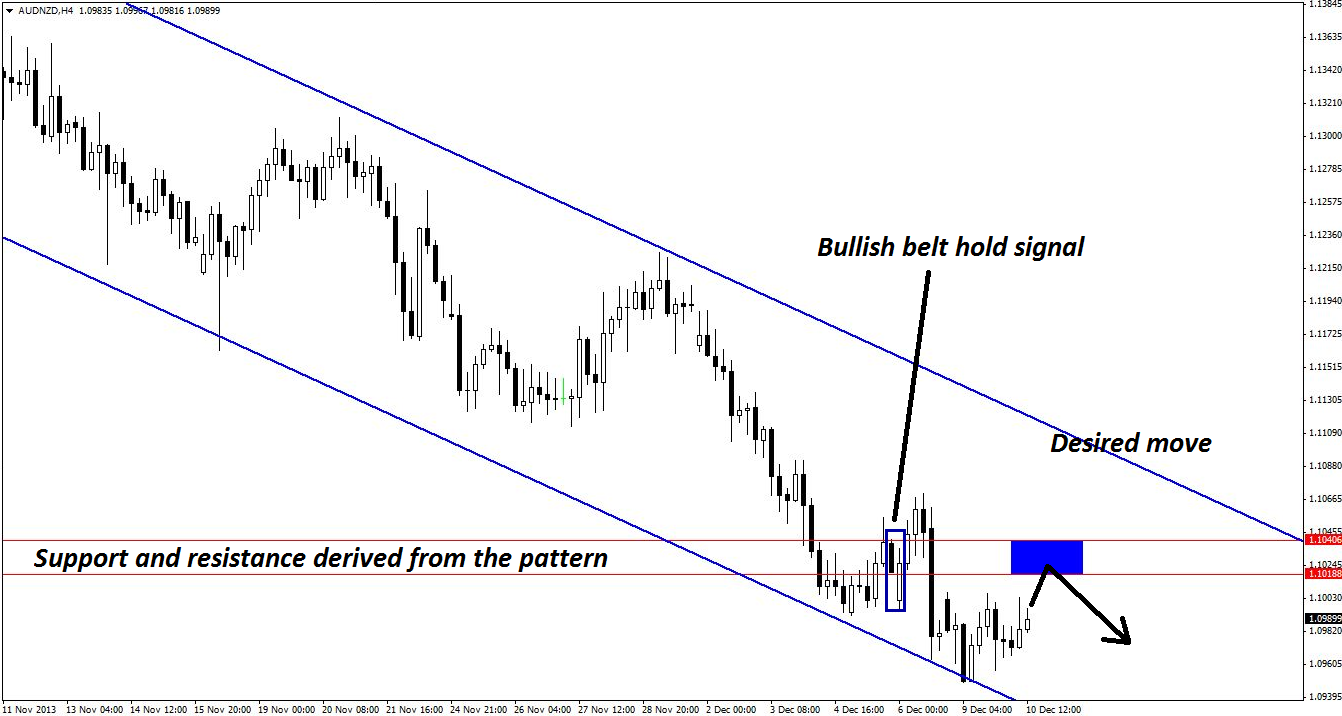

I have been looking at Bread and Butter trader from Mark Rose. This trades 6 instruments, although you could do more if you really wanted to, and is a mixture of stock indices (like FTSE) and ForEx.

The manual comes through snail-mail as a printed document. It’s a comprehensive read and there are plenty of online videos to support the material in the manual.

The system is easy to configure, and so are the alerts.

The system can be traded on any time frame, although 5 minute to 30 minute is advised. I went for 15 minute as I didn’t want to be tied to a lot of screen time and this time frame should reduce the number of false signals.

I traded the six instruments contained in the manual: FTSE, Dax, Dow, EurUsd, GBPUsd and EurGBP.

I used the standard £10 per pip as well as a rolling 2% risk on a £2,500 starting bank. Trades with stops of 10 pips or less used a 2:1 risk/reward target. Trades with a stop of over 25 pips used a 1:1 risk/reward target. All other trades used the two targets, removing half the trade and moving stops to break even half way between the entry and the 1:1 risk/reward target.

Maximum stop loss was 40 pips.

I used the suggested trade windows from the manual but ceasing trading Dow at 6pm London time. NFP and Bank Holidays (US or UK) were no-trade days. Any trades open at the end of my trading day (6 p.m. locally) are closed.

To clarify some trading rules, without describing the system:

- When large rapid moves happen during the trading window I scrub attempting to trade for the remainder of that window, EUR/USD at 07:00 (CET) Tuesday 30th November is a good example of that.

- I also ignore signals when the signal bar is the wrong colour. For a sell the signal bar has to a bear bar (red on my charts), and for buys a bull bar (green for me). So, I will not take a buy where the signal bar is a bearish red bar.

- Trades must trigger within 3 to 4 bars. If the stop-loss value is hit before the trade has triggered then I ignore that signal also.

- Any trades open at the end of my trading day (6 p.m. locally) are closed.

The breakdown per instrument is

| GBPUSD | EURUSD | EURGBP | FTSE | Dax | Dow | Total |

| £ 1,387.50 | -£ 519.00 | -£ 482.50 | £ 1,045.00 | £ 865.00 | £ 2,200.00 | £ 4,496.00 |

With an overall profit of £4,500 in ten weeks using £10 stakes, I am very impressed. The system is easy to use and very profitable. Using 2% risk off a £2,500 starting bank saw a profit of £619, a 25% profit! Needless to say this is APPROVED.

The stock indices did better than the currencies, and going forward I am going to retain stocks and add Oil and perhaps Gold, but will probably drop the currencies as this reflects my personal trading style more closely.

For my personal trading I have also added Pivots and Support and Resistance analysis (in the form of Supply and Demand zones). Don’t worry if this statement is pure gibberish to you, you don’t need to know this stuff to understand this system or to be successful. However, I do recommend that beginners to ForEx take the BabyPips tutorials as some understanding of Support & Resistance (or as Mark advises “look left”) will improve your success.

Can this be used by 9to5ers and folks who do not want to be tied to a PC all day? Absolutely, the alert system is such that if you can react promptly you should be able to get most of the trades. I didn’t use the alert system as I refuse to have a mobile phone, and I used GKFX MT4 platform anyway (and coded my own alert system). Still, most trades appeared to provide an entry well after the signal and whilst you may miss some winning trades, you’ll miss some losers as well.

Usual caveats apply:

Trading ForEx is discretionary; I’ll see trades other people won’t and miss trades that they take. We all read the market differently; therefore your results will be different from mine. Further, I am experienced trader with over 4 years’ experience. Although I try my best not to colour my trials with this experience it is impossible to remove it completely.

Please also note that for ease of reporting I am using GKFX and not Capital Spreads. There are some minor differences in the data feed and indicator calculations.

Purchase Mark Rose – Bread and Butter Trader courses at here with PRICE $2074 $394

Cultivate continuous growth with the Mark Rose – Bread and Butter Trader course at Utralist.com! Unlock lifetime access to premium digital content, meticulously designed for both career advancement and personal enrichment.

- Lifetime Access: Enjoy limitless access to your purchased courses.

- Exceptional Value: Benefit from savings up to 80% on high-quality courses.

- Secure Transactions: Your payments are always safe and protected.

- Practical Application: Gain real-world skills applicable to your goals.

- Instant Accessibility: Begin your learning journey immediately after buying.

- Device Compatible: Access your courses seamlessly on any device.

Transform your potential with Utralist.com!

Related products

= 311 Points

Forex and Trading

Elliott Wave The Futures Junctures Technical Toolbox – Jeffrey Kennedy

= 75 Points

Forex and Trading

= 23 Points

Forex and Trading

= 63 Points

Forex and Trading

= 25 Points

Forex and Trading

= 53 Points

Forex and Trading

= 45 Points

Forex and Trading

= 33 Points