$160.00 Original price was: $160.00.$43.00Current price is: $43.00.

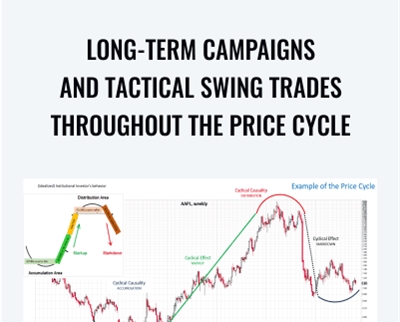

In this long-anticipated series, Roman will describe in detail his approach to long-term campaigns and how he uses swing trades to hedge against his core positions during reactions. Appropriate for ALL LEVELS of students, these three webinars will focus on identifying

Purchase this course you will earn 43 Points worth of $4.30

Purchase this course you will earn 43 Points worth of $4.30Elevate your skills with the Long-Term Campaigns And Tactical Swing Trades Throughout The Price Cycle – Wyckoff Method course, available for just $160.00 Original price was: $160.00.$43.00Current price is: $43.00. on Utralist.com! Browse our curated selection of over 60,000 downloadable digital courses across diverse Uncategorized. Benefit from expert-led, self-paced instruction and save over 80%. Start learning smarter today!

This class serves as one of the three elective courses required to complete your certification.

In this long-anticipated series, Roman will describe in detail his approach to long-term campaigns and how he uses swing trades to hedge against his core positions during reactions. Appropriate for ALL LEVELS of students, these three webinars will focus on identifying, in advance, long-term institutional trends as well as trading tactics to deploy during the Price Cycle, focusing on augmenting your total campaign returns with swing trades. This Special represents the culmination and synthesis of the “Intraday,” “Swing” and “Long-term Campaigns” trilogy that Roman has developed and refined over the past five years.

As huge institutions begin to make significant commitments of capital, we can observe a change of behavior in Price and Volume, which is confirmed by the emergence of new momentum and relative out-performance. These tell-tale signs can facilitate our identification and selection of stocks that can produce substantial absolute and relative returns. This Special will provide you with clear guidelines to help you correctly identify directional bias and timing, and to unravel the “mysterious” character of the developing trend, specifically its potential velocity and sustainability.

The main intention behind this Special is to present a highly systematic approach of trading in alignment with “smart” institutional money. Specifically, you will learn how to:

- (1) Find the strongest long-term campaign candidates,

- (2) Trade them for the long haul,

- (3) Capitalize on short-term swings and hedge against your core position, and

- (4) Automate parts of the process.

Each of the videos has accompanying slides, which can be printed out to allow you to take notes on as you watch the presentations. You will have one full year from the date of purchase to view and review the videos!

Get Long-Term Campaigns And Tactical Swing Trades Throughout The Price Cycle – Wyckoff Method, Only Price $47

Session 1: Main Concepts

- The Price Cycle revisited

- Mapping the Price Cycle

- Best tactical trades within a full Price Cycle

- Long-term campaign trades

- Campaign trade characteristics

- Using swing trades to enhance your long-term strategy

- Homework assignment

Session 2: Trade Selection

- Homework review

- Selection criteria for:

- Campaign trades

- Swing trades

- Optimal market environments for long-term and swing campaigns

- Homework assignment

Session 3: Illustrative Case Studies, Filtering and Scanning

- Homework review

- Case study: Assessing the probable sustainability of a trend

- Case study: Trading and hedging during market crashes

- Filtering and scanning

- Long-term campaign scans developed by “Johnny Scan” (aka John Colucci, the presenter for our popular October 2019 Special, “Scan for Success: Prospecting for Actionable Wyckoff Trade Candidates.”

Get Long-Term Campaigns And Tactical Swing Trades Throughout The Price Cycle – Wyckoff Method, Only Price $47

Tag: Long-Term Campaigns And Tactical Swing Trades Throughout The Price Cycle – Wyckoff Method Review. Long-Term Campaigns And Tactical Swing Trades Throughout The Price Cycle – Wyckoff Method download. Long-Term Campaigns And Tactical Swing Trades Throughout The Price Cycle – Wyckoff Method discount.

Cultivate continuous growth with the Long-Term Campaigns And Tactical Swing Trades Throughout The Price Cycle – Wyckoff Method course at Utralist.com! Unlock lifetime access to premium digital content, meticulously designed for both career advancement and personal enrichment.

- Lifetime Access: Enjoy limitless access to your purchased courses.

- Exceptional Value: Benefit from savings up to 80% on high-quality courses.

- Secure Transactions: Your payments are always safe and protected.

- Practical Application: Gain real-world skills applicable to your goals.

- Instant Accessibility: Begin your learning journey immediately after buying.

- Device Compatible: Access your courses seamlessly on any device.

Transform your potential with Utralist.com!

Related products

Uncategorized

= 85 Points

= 85 Points

= 125 Points

= 65 Points

Uncategorized

Managing Geriatric Behaviors: Wandering, Aggression, Malnutrition and More – Steven Atkinson

= 35 Points

Uncategorized

= 35 Points

Uncategorized

Legal Risks in Nursing Documentation – Use Extreme Caution When Skimming the Facts – Rosale Lobo

= 40 Points

Uncategorized

Disordered Eating Behaviors: Identify and Treat the Underlying Trauma – Lori Kucharski

= 85 Points